NGT notices against modification in Doon Notification ,1989 allowing setting up of ‘red and orange’ category industries in Doon valley by BJP government

NGT notices against modification in Doon Notification ,1989 allowing setting up of ‘red and orange’ category industries in Doon valley by BJP government

Dehradun, Aug 7

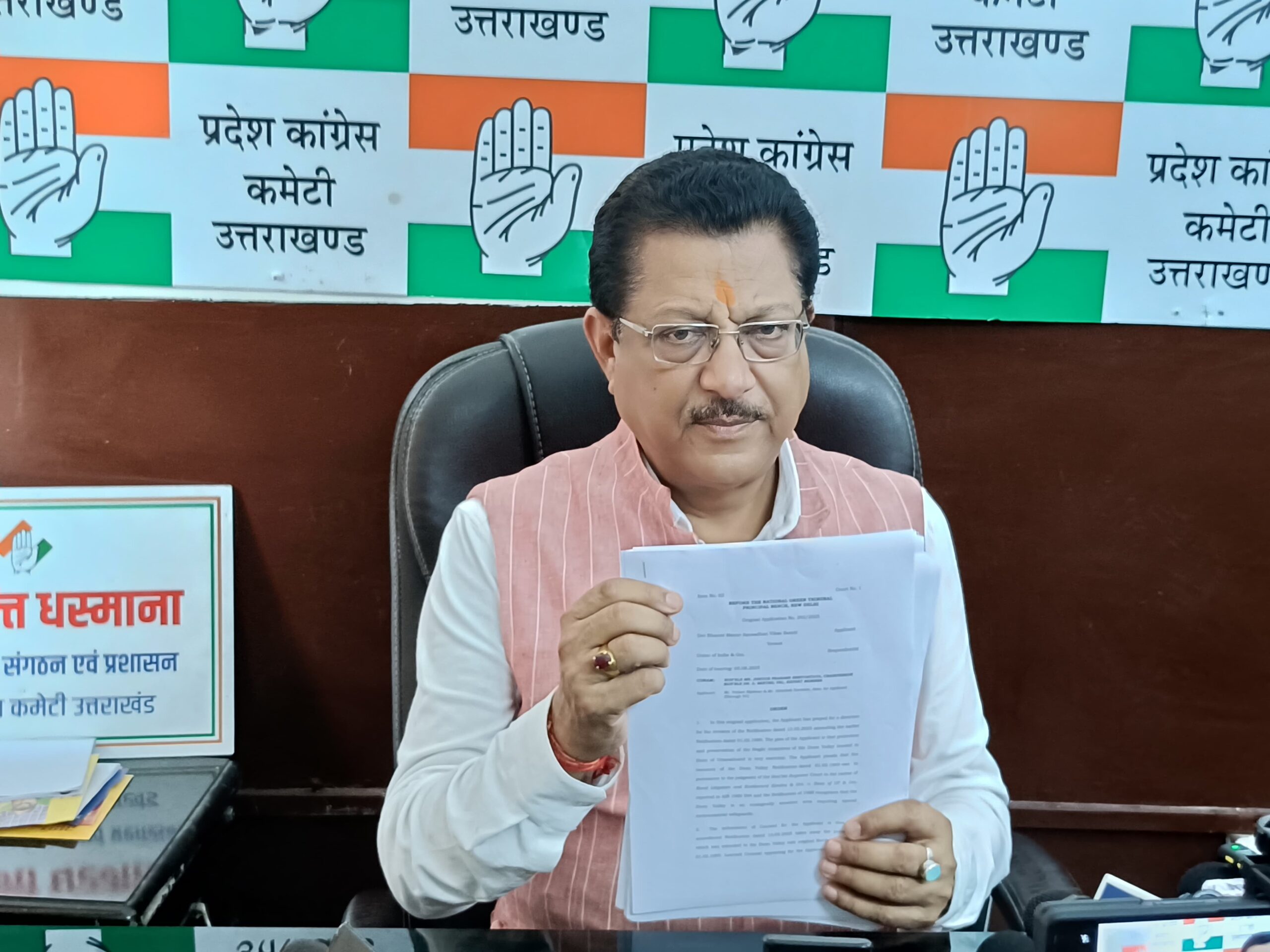

National Green Tribunal (NGT) has issued notices to the Central Government’s Environment and Forest Ministry, Meteorological Department, Central Pollution Control Board, Uttarakhand Pollution Control Board and Uttarakhand Chief Secretary on a petition filed by Devbhoomi Human Resource Development Committee and Trust through its’ president Suryakant Dhasmana against the modification of Doon Notification of 1989 by the present BJP government to allow ‘red and orange’ industries in the ecologically fragile Dehradun valley. The NGT has issued notices and asked the respondents to reply by September 19, 2025.

Suryakant Dhasmana who is also senior vice-president of Uttarakhand Congress informing about the NGT petition, here today alleged that the present Uttarakhand BJP government by providing wrong facts and incomplete information got a new notification issued on May 13, 2025 in which the consent or no objection of the central government will not be required for setting up ‘red or orange’ categories of industries. Now the state government will be able to give its’ consent. Earlier, the central government notification of February 2, 1989 on the orders of Supreme Court had barred any such activity in the Doon valley.

Dhasmana alleged that the move by the BJP government would be disastrous for Dehradun which is already suffering from increased human interference, urbanisation, deforestation and pollution.

He further said that the petition has been filed with an aim to save the air quality of Dehradun, its natural beauty, its rivers, streams, canals and the remaining forest areas, water sources, and the remaining agricultural land.

Dhasmana charged that the state government unable to attract industries are now trying to help their industrialist friends by allowing them to have ‘red and orange’ category industries adding to the worsening situation of Doon valley. He said that the 1989 order of Supreme Court to ban mining in Mussoorie and later Doon Valley notification of 1989, aimed at preserving the natural pristine glory of Dehradun and Mussoorie butt the present BJP government wants to further destroy the ecology of the area by allowing dangerous industries in Doon.

He said that the 1989 notification was cancelled by presenting wrong and misleading facts before the central government. He further alleged that indiscriminate mining is taking place in the state, trees are being cut, land use being changed anywhere without thinking, and the very existence of Dehradun would be in danger if the notification issued by the central government in 1989 giving special status to the Dehradun valley by the honourable Supreme Court remain cancelled. He further said that Dehradun falls in seismic category four and five and there is need for extreme caution in dealing with such sensitive issues which concern the survival of the people and Doon valley. He vowed to fight against the state government move legally, politically and socially.